If we were providing commentary solely about what happened in the first quarter of 2025, this would be a pretty normal update. US markets gave back much of their post-election rally in the first quarter of the year, with many of the major indices (S&P 500®, NASDAQ, Russell 2000) finishing a few percentage points below where they opened the year. International markets performed notably better, with a few of the major international indices finishing the quarter up over 5%.

And then, April began.

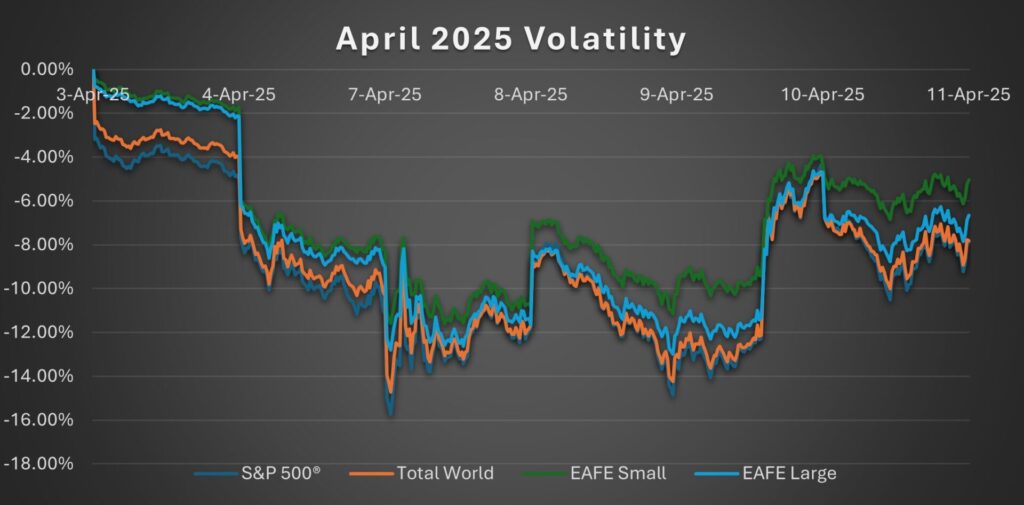

After markets closed on April 2nd, the White House announced their long-awaited tariff plans. When markets opened on the morning of April 3rd, we saw global markets react to the news. This is a good visual representation of what volatility and uncertainty can look like:

Source: Yahoo! Finance Advanced Charts (SPX, VT, SCZ, EFA)

As this chart shows, major indices across the world moved in tandem as countries everywhere reacted to the new policies. Aside from the brief, albeit significant, rally on Wednesday April 9th, markets have been having a difficult time adjusting to the uncertainty. This probably isn’t news to anyone; everywhere you look, someone is talking about tariffs and their potential impact on inflation, employment, and financial markets. It’s almost unavoidable. And yet, in a world where everyone can (and often does) have an opinion, the truth is that nobody knows exactly where we’re headed.

Is this a Blip or a Correction?

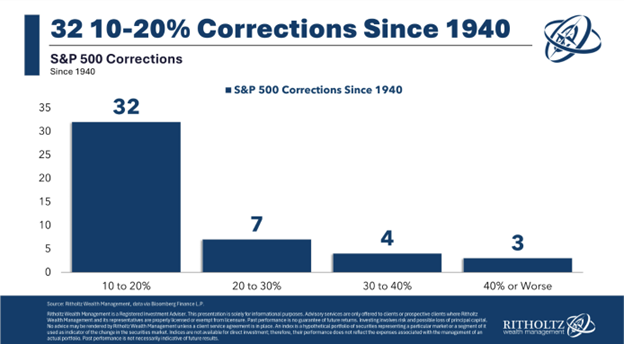

This is the million (or trillion?) dollar question. The downturn we’ve seen over the past week has a clear catalyst in the newly introduced tariff policies. These tariffs will undoubtedly have an impact on global trade and affect virtually every economy in the world. The biggest unknown is whether negotiations will take place, or whether more changes will be made to the original plan that will cause additional swings in the market. Here’s some context on market downturns, or corrections, throughout recent history.

Source: A Wealth of Common Sense, Ben Carlson, CFA

How might Tariffs affect my portfolio?

Since the year 1940, the S&P 500® has seen 46 double-digit corrections. Most of these corrections did not turn into true bear markets, defined as a drawdown of 20% or more. As the data shows, only 14 times in the past 85 years have we seen true bear markets. Of those bear markets, half have seen drawdowns of 30% or more.

While the past isn’t a perfect representation of what is yet to come, we have already seen signs of life as tariff policies have changed, and the focus of the White House has shifted to our trading arrangements with China.

Some economists and analysts will argue that a correction is needed in certain areas of the market. Large US companies are historically expensive, and the major question is whether the high price of these companies is the new normal, or if valuations will come back down to earth. If this downturn is just a blip and markets make a comeback, will every index recover equally? Or will those indices that have been seen as overpriced see a slower climb out of this hole? That is yet to be seen, but the uncertainty surrounding the recovery of these battered asset classes is exactly why we take a diversified approach.

How can diversification help?

As financial advisors, some of the most important conversations we have with clients are about staying invested during times of uncertainty. Market volatility can be extremely uncomfortable, even for the most seasoned investor. But history shows us that those who are invested for the long-term and those who remain disciplined are often rewarded.

Attempting to time the market (jumping out during downturns and back in during rallies) can lead to missed opportunities and significantly impact portfolio growth. The key is to remember that volatility is a normal part of investing. Short-term fluctuations rarely reflect the long-term trends of the market. Staying the course during turbulent times requires patience, but it also builds resilience and helps position portfolios to benefit when markets recover.

Equally important is maintaining a diversified portfolio that aligns with your goals and risk tolerance. Diversification helps reduce risk by spreading investments across asset classes, industries, and geographies, so that no single event derails your entire plan. This is as important as ever when you consider what we previously mentioned about the price of US Large Cap stocks (for context, US Large Cap stocks are down 7.5% YTD while International Large Stocks are up 2.0%).

Diversification also plays a critical role in helping investors avoid emotional decisions driven by the fear of missing out (FOMO). Chasing performance or putting all your eggs into one basket can lead to concentrated risk and poor outcomes if trends reverse. By sticking to a thoughtfully constructed, diversified portfolio, you’re not only managing risk more effectively, you’re also giving yourself a better chance at achieving consistent, long-term success.

To summarize – stay the course and stay diversified. Remind yourself that history has given us many examples of uncertainty and volatility, and long-term investors have weathered many storms by staying true to their principles. If you want to sit down and talk about the current financial climate, or you have questions about your portfolio, please reach out to us. We’d love to talk to you.

It is generally not possible to invest directly in an index. Exposure to an asset class or trading strategy or other category represented by an index is only available through third party investable instruments (if any) based on that index.

This information has been prepared by Frontier based on data and information provided by internal and external sources. While we believe the information provided by external sources to be reliable, we do not warrant its accuracy or completeness. Nor should their use be construed as an endorsement.

Past performance is no guarantee of future returns. Nothing presented herein is or is intended to constitute investment advice or recommendations to buy or sell any types of securities and no investment decision should be made based solely on information provided herein. There is a risk of loss from an investment in securities, including the risk of loss of principal. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular investor’s financial situation or risk tolerance. Frontier is not responsible for any trading decisions, damages or other losses resulting from this information, data, analyses, opinions or their use. Diversification does not ensure a profit or protect against a loss. All performance results should be considered in light of the market and economic conditions that prevailed at the time those results were generated. Before investing, consider investment objectives, risks, fees and expenses.

Elevate Wealth Management is the financial planning division of Frontier Asset Management. Frontier Asset Management is a Registered Investment Adviser with the Securities and Exchange Commission. The firm’s ADV Brochure and Form CRS are available at no charge by request at info@frontierasset.com or 307.673.5675 and are available on our website www.frontierasset.com. They include important disclosures and should be read carefully.

20250411.11111